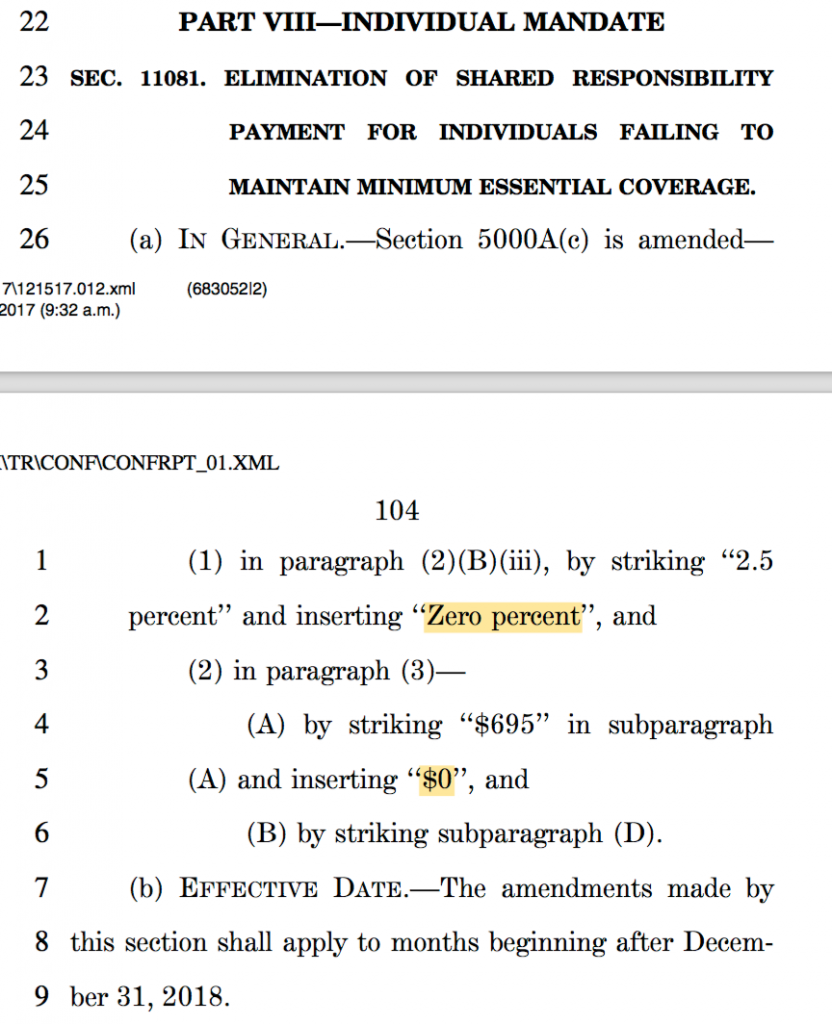

My only interest in the recently-enacted tax bill is that it zeroed out the individual mandate. Five years after Chief Justice Roberts said the judgment about whether to impose a purchase mandate is a “judgment . . . for the people acting through their representatives,” the Representatives have made a different judgment. It is remarkable how little attention this provision has garnered.

Now, there are grumblings among the law professoriate that the tax bill itself may be unconstitutional. Why? Because it caps the federal deduction for State and Local Taxes (SALT), which high-income earners in blue states are more likely to pay. Mike Dorf theorizes how this provision could run afoul of the Equal Protection Clause, the First Amendment, and even the “Equal Sovereignty of States” principle of Shelby County. Norm Eisen tweeted a “due process” argument along with a winky-emoticon. Darien Shanske said Congress’s decision to limit the federal deduction for SALT would violate the 10th Amendment. Kirk Stark predicted that such a federalism challenge could gain traction: “Courts create new law all the time.”

Will any states sue on this matter? Again, only grumblings.

This sort of argument, though, is not novel. One of the earliest lines of attack against the ACA in late 2009 was that the Cornhusker Kickback violated the Equal Protection Clause, because it treated the states unequal. That is, the law imposed certain costs of 49 states that 1 state did did not have to make. This is not exactly the same legal argument concerning SALT deductions, but it has the same feel to it. Because this issue arose before Shelby County was decided, advocates grounded it sounded in Equal Protection.

On December 30, 2009, Attorneys General from 13 states threatened to challenge the ACA in court based on, among other grounds, the Equal Protection Clause:

The fundamental unfairness of H.R. 3590 may also give rise to claims under the due process, equal protection, privileges and immunities clauses and other provisions of the Constitution. As a practical matter, the deal struck by the United States Senate on the “Nebraska Compromise” is a disadvantage to the citizens of 49 states. Every state’s tax dollars, except Nebraska’s, will be devoted to cost-sharing required by the bill, and will be therefore unavailable for other essential state programs. Only the citizens of Nebraska will be freed from this diminution in state resources for critical state services. Since the only basis for the Nebraska preference is arbitrary and unrelated to the substance of the legislation, it is unlikely that the difference would survive even minimal scrutiny.

Note that it was the Medicaid expansion, and not the individual mandate, that drew the State Attorneys General to the case. I discussed in Unprecedented how the tail truly wagged the dog:

The relationship between the states and the mandate is even more bizarre. The states initially threatened litigation to challenge the Medicaid expansion. However, once the unpopularity of the mandate became obvious, many of the Republican attorneys general saw political gold and shifted their focus. Why states were the leaders in opposing a law whose impact was on individuals, not on states, is not clear, though soon enough the challenge to the mandate became the tail wagging the Medicaid dog. (Alas, nearly all of the attorneys general who joined this suit and sought higher office were defeated.)

This Equal Protection argument even made it into a constitutional point of order made by Sen. Kay Bailey Hutchinson (R-TX) on the eve of the Senate’s Christmas Eve vote for the ACA. From Unprecedented:

Senator Hutchison attacked the special carve-outs for Louisiana and Nebraska as unconstitutional, citing the Constitution’s guarantee of equal protection of the laws: “The deals that have been made to get votes from specific senators cannot be considered equal protection under the law.” Many states became leery at the prospect of Louisiana and Nebraska receiving sweetheart deals while they were forced to pay a lot of money for the Medicaid expansion.

Here is the text of her speech:

In 2011, we see $60 billion in taxes on insurance companies except for companies in two particular States. That does not seem fair. Fortunately, the Constitution’s equal protection clause may have something to say about this gross situation. This will not stand the test of the Constitution, I hope, because the deals that have been made to get votes from specific Senators cannot be considered equal protection under the law. … The individual fixes for certain States, presumably to get the votes of certain Senators, do not pass the test of transparency. If you put it in the nicest way, it does not pass the test for fairness, for due process and equal treatment under the law, and it certainly does not pass the test for what is the right way for us to pass comprehensive reform legislation.

The Equal Protection argument never even made it into the States’s complaint.

Last January, I predicted that progressive states would turn to Federalism as a means to resist President Trump’s agenda. I would not have predicted that progressive states would challenge federal tax laws as violations of the Tenth Amendment. Dan Hemel cogently explains why this is a bad idea for the left:

“The Democratic Party’s long-term agenda requires the federal government being able to raise revenue,” Mr. Hemel said. “This would be short-termism at its worst, potentially setting back the progressive agenda for decades to come in response to a bad tax bill.”