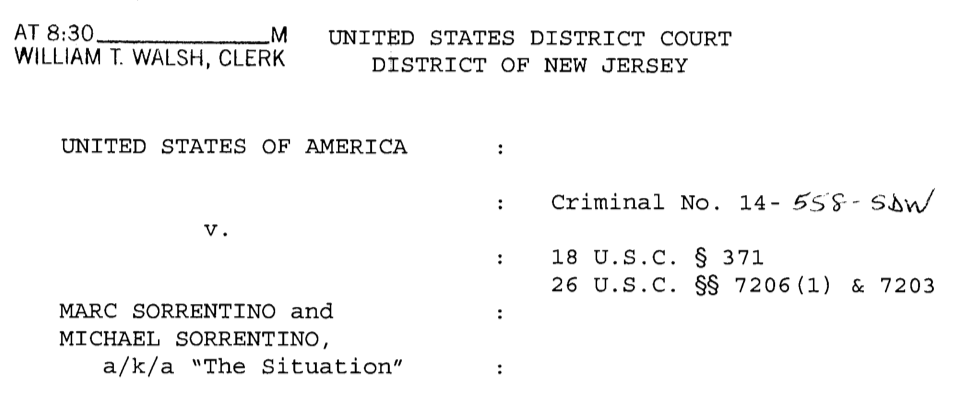

Longtime readers of this blog will know that I have a (not-so) shameful appreciation of all things Jersey Shore. Now, two of my passions, Jersey Shore and the Federal Courts have collided in the District of New Jersey. Michael “The Situation” Sorrentino has been indicted on charges of tax evasion!

The caption makes me so happy. A/K/A “The Situation”

This looks really bad for Sitch:

Mike “The Situation” Sorrentino and his brother, Marc, faced a federal judge Wednesday afternoon after they were indicted for failing to pay taxes on $8.9 million in income.

The tuxedo-clad duo looked nervous for their court appearance in Newark federal court on charges of conspiracy to defraud and filing false tax returns.

Both sides agreed to pretrial conditions for the defendants that would allow them to stay at their residences near the Jersey shore.

As the brothers walked out of the courtroom, a Post reporter asked how they would describe their situation.

Mike only smiled and raised his eyebrow.

When asked if he was guilty, he shot back, “No, I’m innocent. That’s why I pleaded not guilty.”

According to the indictment, Sorrentino and his brother submitted bogus IRS returns for his companies – Situation Nation, Situation Productions and MPS — from 2010 to 2012.

They allegedly hammered out contracts with booking agencies for paid appearances at clubs, bars and liquor stores, but the money only went to line their own pockets.

The booking fees would typically range from $1,500 to $48,000 for each appearance and was paid to them in cash, the documents state.

In 2010, the brothers made $184,000, $154,000 in 2011 and $31,000 in 2012, but they didn’t pay the government a dime in taxes, according to the indictment.

“The Situation” also blew off filing a 2012 tax return in 2011 after he took in $1.95 million the previous year.

It seems that Lois Lerner had Jersey reality stars on a BOLO (be on the lookout for) list.

The duo is being investigated by the same office that prosecuted Teresa and Joe Giudice of The Real Housewives of New Jersey.

Though, speaking of the IRS, this admonition from the U.S. Attorney is just a tad ironic.

US Attorney Paul Fishman blasted the duo, saying, “Michael and Marc Sorrentino filed false tax returns that incorrectly reported millions made from promotions and appearances. The law is absolutely clear: telling the truth to the IRS is not optional.”

But the IRS need not tell the truth.

Anyway, here are the key paragraphs from the indictment:

2. From in or about January 2010 through in or about November 2013, in Monmouth and Ocean Counties, in the District of New Jersey and elsewhere, defendants

MARC SORRENTINO a n d

MICHAEL SORRENTINO, a/k/a “The Situation,”

did knowingly and intentionally conspire and agree with each other and others to defraud the United States by impeding, impairing, obstructing, and defeating, through deceitful and dishonest means, the lawful functions of the IRS, a constituent agency of the United States Department of the Treasury, to ascertain, compute, assess, and collect federal income taxes .

Object of the Conspiracy

3. The object of the conspiracy was to impede, impair, obstruct, and defeat, through deceitful and dishonest means, the lawful functions of the IRS, a constituent agency of the United States Department of the Treasury , to ascertain, compute, assess, and collect federal income Manner and Means of the Conspiracy4. It was part of the conspiracy that defendants MARC SORRENTINO and MICHAEL SORRENTINO earned approximately $8. 9 million in gross income on which they failed to pay all federal income taxes due and owing.

And he earned up to $48,000 for a booking fee:

8. Defendants MARC SORRENTINO and MICHAEL SORRENTINO entered into numerous contracts with booking agencies for the purpose of defendant MICHAEL SORRENTINO making personal appearances at various venues, including nightclubs, bars, and liquor stores, in exchange for a booking fee . The booking fee typically ranged from $1,500 to $48,000 per appearance. Generally, a substantial porti on of the booking fee would be paid in cash direct l y to defendants MARC SORRENTINO and/or MICHAEL SORRENTINO by the venue on the date of the appearance. Defendants MARC SORRENTINO and MICHAEL SORRENTINO deposited some of the aforementioned cash that they received into the bank accounts controlled by the defendants.

A grand jury was convened in the fall of 2013, and they altered records!

15. It was further part of the conspiracy that on or about November 13, 2013, in response to federal Grand Jury subpoenas dated October 9, 2013, MPS and SitNat produced QuickBooks software containing books and records for tax year 2012. However, after the Grand Jury subpoenas were served upon MPS and SitNat, but prior to MPS and SitNat producing the books and records, numerous journal entries in the QuickBooks books and records were altered. Specifically, on or about November 6, 2013, journal entries that had originally been entered as taxable payments to defendant MARC SORRENTINO were altered and reclassified as non-taxable payments to defendant MARC SORRENTINO.