Reports have suggested that the Congressional Budget Office will release their analysis this week of the American Health Care Act, including the all-important forecast of how many Americans will lose coverage. The office’s track record is, well, not very good. CBO vastly overestimated the number of Americans who would enroll on the exchanges and pay the individual mandate penalty. Each year, CBO revised their estimates lower and lower, and still never quite predicted how weak the enrollment would be. This post is not meant as a critique of CBO’s methodology, but rather a frank recognition that even the best experts cannot predict, with any accuracy, the impact of such a massive government program. Indeed, in June 2014, CBO threw in the towel on scoring Obamacare’s complete impacts:

“The provisions that expand insurance coverage established entirely new programs or components of programs that can be isolated and reassessed,” the office wrote.

“In contrast, other provisions of the Affordable Care Act significantly modified existing federal programs and made changes to the Internal Revenue Code.

“Isolating the incremental effects of those provisions on previously existing programs and revenues four years after enactment of the Affordable Care Act is not possible.”

In the Epilogue of Unraveled, I tracked the accuracy of CBO’s forecasts concerning the Affordable Care Act from 2009 to 2015. I will reproduce that section here.

—

Enrollments on the ACA Exchanges

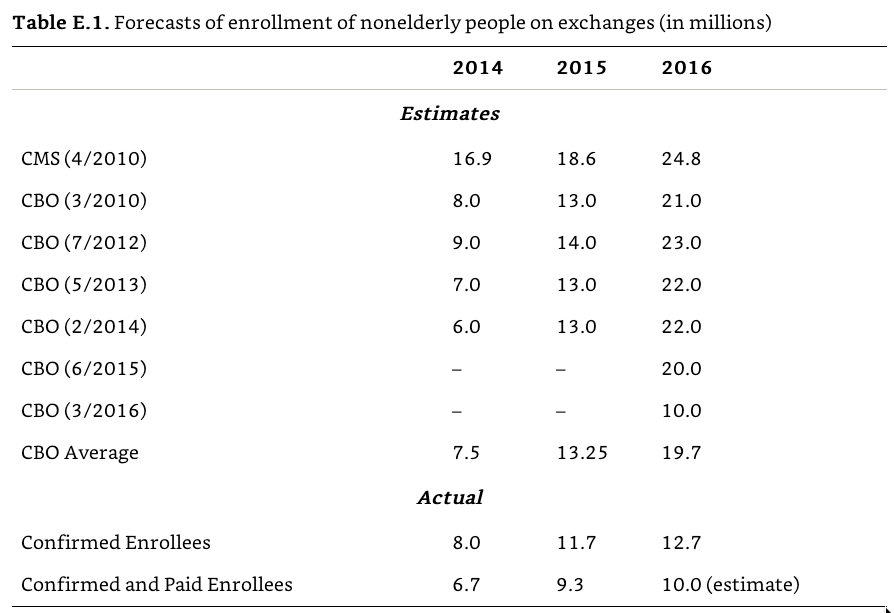

Chapters 14 and 18 recounted the stunning turnaround of HealthCare.gov, as 8 million customers enrolled by April 2014. In light of the botched launch of the website six months earlier, this result was nothing short of miraculous. However, the enrollments on the exchanges lag far, far behind government estimates. To assess these gaps, Table E. 1 provides forecasts from the Centers for Medicare and Medicaid Services (CMS) in 2010 – before the ACA passed the House – and from the Congressional Budget Office (CBO) in 2010, 2012, 2013, 2014, 2015, and 2016.30 These predictions are contrasted with the actual number of enrollees, and the number of enrollees who continued to pay their premiums throughout the year.

In 2014, Obamacare met the CBO’s original goal from 2010, as well as the average forecast, with 8 million enrollments. This was truly a red-letter year for the ACA, demonstrating that there was strong demand for the exchange policies. After 2014, however, the demand has leveled off. In 2015, there were 11.7 million enrollments, far fewer than the CBO’s average forecast of 13.25 million. From 2010 through 2015, CBO consistently predicted that enrollments would spike up in 2016, with 20– 24 million enrollments. For example, in its February 2014 report, CBO wrote that “more people are expected to respond to the new coverage options, so enrollment is projected to increase sharply in 2015 and 2016.”

The surge never happened. In March 2016, CBO drastically downgraded its forecast by half to 10 million enrollees. As of July 2016, there have been 12.7 million confirmed enrollees on the exchange – beating the revised 10 million figure, but falling significantly short of the expected 20 million. Brian Blase, of the free-market Mercatus Center, observed that the “magnitude of how wrong the initial predictions appear to be should cause legislators and the public to approach future estimates of the impact of major legislation cautiously.” 31 Contrary to the forecasts, he wrote, “people [found] exchange plans so much less attractive than experts assumed when the law was passed,” and even after two years of the marketplace being open. The ACA’s expansion of coverage to 20 million Americans is still far short of even its most conservative estimate of more than 30 million Americans gaining coverage.

As weak as these enrollment numbers are, the actual numbers of customers who continued to pay their policies for nine consecutive months is even lower. In 2014, only 6.7 million out of 8 million enrollees paid their premiums through September. 32 This 19% drop-off puts the 2014 figures well below the CBO forecasts. In 2015, only 9.3 million out of the 11.7 million paid their premiums through September. 33 More than 25% of enrollees failed to consistently pay their bills. In 2016, only 11.1 million out of 12.7 million paid their premiums through March, with an expected 10 million to continue paying through September. 34 Factoring in customers who actually continue to pay for coverage, the state and federal risk pools are barely at 50% of their anticipated size.

The underpayment problem is even more severe because savvy shoppers have learned to game the system: they sign up, receive treatment, and cancel coverage. The ACA was designed to only allow people to sign up at specific times to frustrate this opportunism. In 2009, CBO wrote that in addition to the individual mandate, the ACA’s “annual open enrollment period” would tend to mitigate … adverse selection.” 35 In his brief to the Supreme Court, the solicitor general explained that restricting enrollment to a fixed period “would reduce opportunities for healthy people to wait until illness struck before enrolling.” 36

However, in order to boost raw enrollment numbers, the Obama administration consistently delayed signup deadlines. 37 According to the New York Times, HHS created more than thirty “special enrollment” windows, many of which were only mentioned in “informal ‘guidance documents.’” 38 For example, customers were allowed to sign up late due to unspecified “exceptional circumstances,” “serious medical condition[ s],” and – the most capacious standard – “other situations determined appropriate” by HHS.

The first special enrollment period came shortly after the pivotal March 31, 2014 deadline. Customers were allowed to continue signing up in April. In addition, the Johnny-come-latelies were excused from the individual mandate’s penalty. 39 The Hill reported that the “move essentially nullifies the month of April for the purposes of enforcing the mandate.” 40 Until the very end, the goalposts kept moving to ensure as many people as possible were able to get covered.

In February 2015 – after the regular enrollment period concluded – the Obama administration created another special enrollment period. To qualify, customers had to demonstrate that they were subject to the penalty in 2014 and “first became aware of, or understood the implications of” it when preparing their 2014 return. In other words, people who went uninsured in 2014, and missed the enrollment period in 2015, were able to sign up late because they were unaware that they had to pay a penalty until they did their taxes.

The National Association of Insurance Commissioners complained that “consumers are not required to provide documentation to substantiate their eligibility for a special enrollment period.” 41 Kaiser Permanent, a large health insurer, said that the potential for abuse “poses a significant threat to the affordability of coverage, and to the viability” of the exchanges. In 2016, the Government Accountability Office (GAO) concluded that HHS “has assumed a passive approach to identifying and preventing fraud.” 42 The agency’s honor system policy “allowed an unknown number of applicants to retain coverage, including subsidies, they might otherwise have lost, thus producing higher costs for the federal government.”

Leading insurance companies submitted regulatory comments to HHS, warning that the extra signup windows risked destabilizing the insurance markets. 43 Blue Cross Blue Shield explained that “individuals enrolled through special enrollment periods are utilizing up to 55 percent more services than their open enrollment counterparts.” Aetna added that “many individuals have no incentive to enroll in coverage during open enrollment, but can wait until they are sick or need services before enrolling and drop coverage immediately after receiving services … less than four months” later. United Healthcare, which will exit from most of the Obamacare exchanges in 2017, explained that more than 20% of its customers signed up during a special enrollment period, and they used 20% more health care than those who enrolled during the regular enrollment period. 44 Anthem told the government that these modifications of the deadlines were “harming the stability of the exchange markets and resulting in higher premiums.” The Obama administration’s sign-up-as-many-people-as-possible approach has eliminated one of the key constraints embedded in the ACA and reduced the force of the individual mandate.

Suspending the Individual Mandate

Because insurers could no longer discriminate against customers with preexisting conditions – due to the guaranteed-issue and community-rating provisions – customers could free-ride and “wait to purchase health insurance until they needed care.” 45 As the United States explained to the Supreme Court, this free-riding “would drive up premiums and threaten the viability of the individual insurance market.” 46 The individual mandate was designed to solve this problem. President Obama explained the simple economics behind the mandate during a February 2014 radio appearance: “If you can afford [insurance], and you don’t get it, you’re going to pay a fee. So you might as well just go ahead and get health insurance instead of paying a penalty with nothing to show for it.” 47

Solicitor General Verrilli warned the Supreme Court that the ACA operating without an individual mandate would “create an adverse selection cascade,” the dreaded death spiral, “because healthy individuals would defer obtaining insurance until they needed health care, leaving an insurance pool skewed toward the unhealthy.” Without the mandate, Verrilli wrote, “premiums would increase significantly” and “the availability of insurance would decline.” This implosion, the government explained, was “exactly the opposite of what Congress intended in enacting the Affordable Care Act.” The mandate was essential for nudging the uninsured into the health care market. Yet, the mandate would never go into effect as designed. The government’s numerous exemptions from the mandate’s penatly risked the very parade of horribles the government warned about.

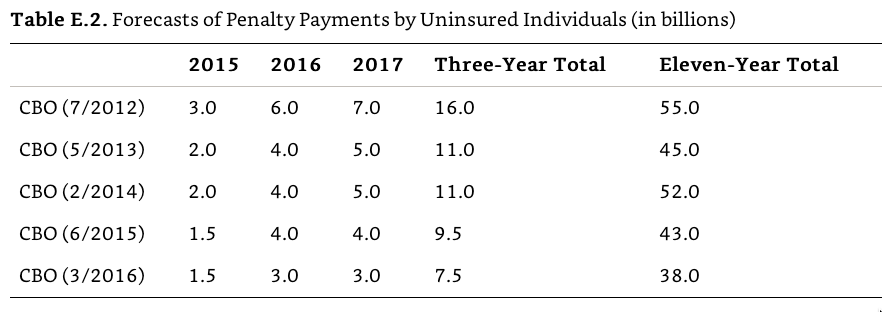

In addition, the revenue generated from the penalties was designed to offset the cost of expanding coverage. In 2015, the penalty for an adult was $ 325, and $ 975 for a household. 48 Table E. 2 provides CBO’s projections of penalty payments (in billions) that the individual mandate was expected to generate.

Like the exchange enrollment numbers, the collected penalty revenue has lagged far behind original estimates. But there is an incongruence to these forecasts. The number of people who have gained covered on the ACA exchange is far fewer than originally forecasted: 10 million instead of 20 million. As a result, more people who otherwise would have obtained coverage, should now be subject to the mandate’s penalty. The revenue should be far greater than originally predicted. But the exact opposite happened. As time progressed, and it became clear that the ACA would fall far short of its projected enrollment numbers, CBO downgraded its forecast for the penalty payments. For example, shortly after the Supreme Court upheld the ACA in NFIB v. Sebelius, CBO expected the individual mandate would generate $ 3 billion in 2015, $ 6 billion in 2016, and $ 7 billion in 2017. In February 2014, CBO revised its forecast for that year to $ 2 billion. Ultimately, it was even less than that. John A. Koskinen, the Commissioner of the Internal Revenue Service, reported to Congress that 7.5 million taxpayers paid an average of $ 200 in penalties, totaling $ 1.5 billion in penalties for 2014.49 CBO’s most recent forecast further lowered its expectations. The budget office predicted a flat $ 3 billion in revenue in 2016 and 2017, and shrank the eleven-year total to $ 38 billion. These numbers do not add up.

Some of this discrepancy is due to fact that fewer business than expected have not cancelled employer-provided plans. “Employers have not ‘dumped’ employees to the extent that some people feared and predicted,” said Ceci Connolly of the Alliance of Community Health Plans. But that explains only part of the gap. 50 A more complete explanation for this incongruence considers the effect of the executive’s actions, which have unexpectedly excused millions of taxpayers from the penalty. In June 2014, CBO wrote that its downward forecast for penalty payments was due “in part to regulations issued since September 2012 by the Departments of Health and Human Services and the Treasury.” 51 As a result, there is “an increase in [its] projection of the number of people who will be exempt from the penalty.” 52

According to the IRS commissioner, 12.4 million taxpayers claimed an exemption from the mandate for 2014.53 Koskinen explained that many taxpayers claimed an exemption because “health care coverage [was] considered unaffordable.” This is not one of the exemptions carved out by Congress in the ACA. 54 Rather, this was a consequence of the president’s executive action in December 2013, which waived the individual mandate’s penalty for taxpayers who told the government that a new policy was too expensive. Recall from our discussion in Chapter 13 that applicants were on the honor system, and their request was not subject to any verification.

At the time, ACA supporters downplayed any impact the waivers would have on the markets. MIT Economist Jonathan Gruber said it was “not an imminent threat to the individual mandate” because it would only be used for “extreme hardships.” 55 This was originally viewed as only a temporary measure. However, four months later, it was extended. In a brief footnote in a seven-page technical bulletin, the government quietly noted that the fix would be extended for two more years until October 1, 2016.56 Once again, applicants were on the honor system, and only had to tell the government they “find other options to be more expensive.”

The Wall Street Journal warned that the never-ending hardship exemption was a “regulatory loophole” that “sets a mandate non-enforcement precedent.” It becomes more and more difficult to eliminate the exemptions for people who cannot afford policies. “The longer it is not enforced,” the Journal noted, “the less likely any President will enforce it.” 57 Kathleen Sebelius defended the waiver to the House Ways & Means Committee. “The hardship exemption was part of the law from the outset,” she said. “There was a specific rationale there, and it starts with the notion that if you can’t afford coverage you are not obligated to buy coverage.” 58 But as we discussed in Chapter 13, the ACA carved out specific income requirements to qualify a hardship exemption. It does not count if Obamacare’s mandates made insurance too expensive. Obamacare itself cannot be the hardship.

The shortfall in individuals paying the penalty can also be attributed to the president’s “if you like your plan, you can keep your plan” administrative fix. Through this November 2013 policy, the federal government allowed insurance companies to continue offering plans that did not comply with the ACA’s strict coverage requirements. Individuals who remained on these grandfathered plans, which did not provide “minimum essential coverage,” would be excused from the individual mandate’s penalty. There were risks to allowing people to remain on old plans. Jim Donelon, president of the National Association of Insurance Commissioners, warned that the administration’s decision “threatens to undermine the new market, and may lead to higher premiums and market disruptions in 2014 and beyond.” 59 Moody’s Investor Service forecasted that the administrative exemption would result in “exposure to adverse selection” and was “likely to negatively affect earnings in 2014.” 60 Harvard economist David Cutler was more cautious. “If it turns out to be a delay of a year, then we can work through that,” he told Megyn Kelly on Fox News. 61 “If it becomes a permanent situation that people who are healthier stay away and people who are sicker go into the exchanges, that becomes a very big problem. That could be the beginning of a death spiral. That is, you could have a situation where people in the exchanges are very unhealthy people with high premiums.”

The fix was originally slated to provide temporary relief for one year. However, that would have resulted in millions of plans being cancelled in the fall of 2014, on the eve of the midterm elections. The president would not let that happen. HHS announced that noncompliant plans could be grandfathered through the end of 2016.62 Insurers were now able to renew noncompliant policies as late as October 1, 2016, so coverage could continue past the next presidential election into 2017. The New York Times observed this action “essentially stall[ s] for two more years one of the central tenets of the much-debated law, which was supposed to eliminate what White House officials called substandard insurance and junk policies.” 63

The Hill reported that the delays would avert the “firestorm for Democratic candidates in the last, crucial weeks before Election Day” 2014.64 Former-House Majority leader Eric Cantor charged that the president “is once again trying to hide the effects of Obamacare. It is not fair to pick and choose which parts of an unpopular law should be enforced.” 65 Senate Republican leader Mitch McConnell said the delay was “a desperate move to protect vulnerable Democrats in national elections later this year.” 66 Indeed, in announcing the policy, HHS said it was crafted “in close consultation” with three Senate Democrats in vulnerable seats: Mary L. Landrieu of Louisiana, Mark Udall of Colorado, and Jeanne Shaheen of New Hampshire. 67 Only Shaheen was reelected.

Extending the grandfathering of noncompliant plans, health care industry consultant Robert Laszewski observed, “tends to undermine the sustainability of Obamacare” because it reduces incentives for customers to purchase policies on the exchanges. 68 And more likely than not, these grandfathered customers are younger and healthier, because they were able to obtain insurance even before the ACA’s guaranteed-issue requirement kicked in. The “administrative fix” has inhibited the exchanges from attracting the young and healthy members who were essential to stabilizing the risk pools. Alan Murray of CareConnect, a New York healthcare plan, observed that after two years, “everybody who’s in the individual market on average is not as healthy as we were led to believe.” 69

The government has not announced how many people benefited from the administrative fix, but we can hazard a guess. A McKinsey report estimated that 3.7 million Americans were still using noncompliant plans that otherwise would have been cancelled under the ACA. 70 An October 2013 Gallup poll found that “[ n] early two in three uninsured Americans say they will get insurance by Jan. 1, 2014, rather than pay a fine as mandated by the Affordable Care Act (ACA), while one in four say they will pay the fine.” 71 If we assume that 2/ 3 of the 3.7 million people whose plans were grandfathered, would have otherwise purchase insurance the exchange, the ranks would have increased by another 2.5 million customers. Assuming the other one-fourth chose to pay the penalty – which averaged $ 200 in 2014 – it would have generated nearly $ 200,000,000 in revenue.

These were only two in a series of ad hoc, unpublicized waivers the Obama administration issued. The New York Times reported that the White House “has already granted … 30 types of exemptions.” 72 The myriad exemptions have skewed the risk pools with older, and sicker, customers, which further drives up premiums, making future policies even less attractive. 73 By exempting millions of Americans from the individual mandate, the Obama administration disturbed the fragile balance Congress designed to prevent an adverse selection death spiral.

Delaying the Employer Mandate and the Cadillac Tax

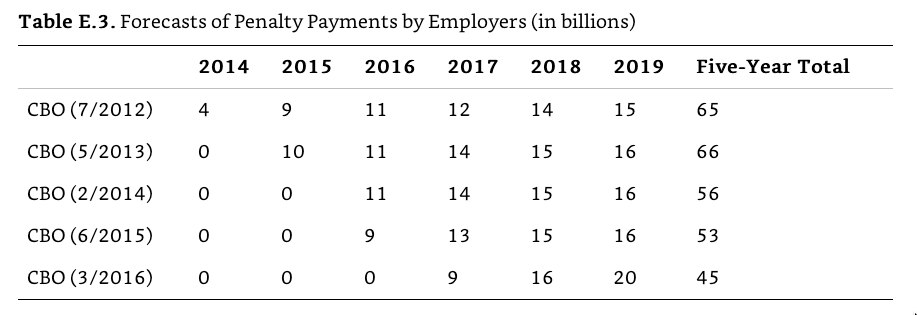

The ACA’s employer mandate requires businesses with more than 50 workers to pay a fine of $ 2,160 for each uninsured employee. In July 2013, the Obama administration announced that the employer mandate would not be enforced in 2014. Seven months later, the administration further postponed the mandate for 2015. Businesses with between 50 and 100 employees were excused from the mandate entirely. Businesses with more than 100 employees would be excused from the penalty so long as 70% of their employees were covered. Starting in 2016, businesses that cover 95% of its workforce will not have to make the payments. (Chapter 13 discussed how none of these requirements were consistent with the statute.) Additionally an unknown number of waivers were granted to favored employers.

The Congressional Budget Office’s downward-sloping forecasts, represented in Table E. 3 reflect this tinkering with the employer mandate. Initially, the mandate was expected to generate $ 24 billion by 2016. After the president’s executive actions, it generated $ 0 through 2016. Additionally, the expected revenue from 2014 through 2019 dropped from $ 65 billion to $ 45 billion. Far fewer employers will be hit with the penalty and have an incentive to provide their workers with insurance.

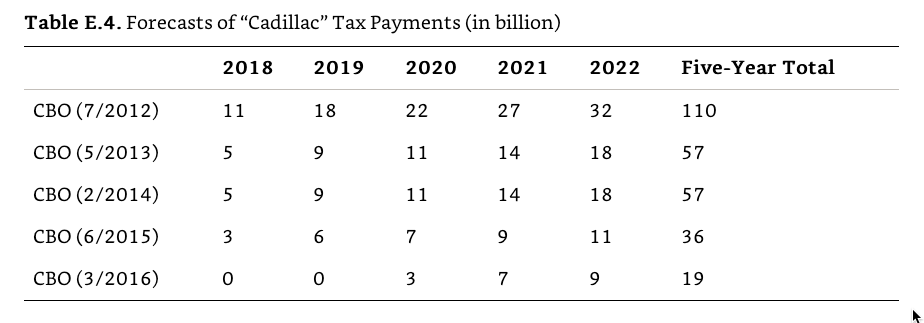

The ACA’s Cadillac tax imposes a 40% excise tax on generous health insurance plans starting in 2018. Popular among economists, the provision would have created an incentive for firms to reduce health care costs. Unpopular among workers – particularly labor unions with gold-plated insurance plans – the excise tax did not stand a chance. Despite President Obama’s initial objection, in December 2015 he approved of Congress’s two-year delay of the Cadillac tax. As a result, the excise is not scheduled to go into effect until 2020. As we discussed in Chapter 29, it is unlikely this unpopular provision will ever go into effect. This delay has greatly altered the revenue the Cadillac tax was expected to generate, as illustrated by Table E. 4.

Under the CBO’s initial estimate, employers were expected to pay $ 110 billion in taxes for Cadillac plans between 2018 and 2022. This payment was a pivotal offset in order for the ACA to achieve a budget-neutral scoring. Now, with the delay of the Cadillac Tax, CBO only projects the excise will generate $ 19 billion through 2022. This number could very likely drop to $ 0 if the Cadillac Tax is perpetually delayed. When assessing a law that transformed nearly 20% of the U.S. economy, it is not enough to focus only on how many people gained coverage; we must also consider the costs of achieving this goal. The Affordable Care Act has fallen far short of its great expectations.