In January, LawProf Seth Chandler identified what seems to be an illegal practice of the federal government raiding the U.S. Treasury, and redistributing funds to suffering insurance companies. To grossly oversimplify, a provision of the ACA requires CMS to tax insurance companies. Part of that assessment is then redistributed to other insurance companies that suffered losses (about $10 billion in 2014), and another portion is to be distributed in the U.S. Treasury (about $2 billion in 2014). The government paid $0 to the Treasury, and paid all of the collected assessments (which totaled far less than $10 billion) to suffering insurance companies.

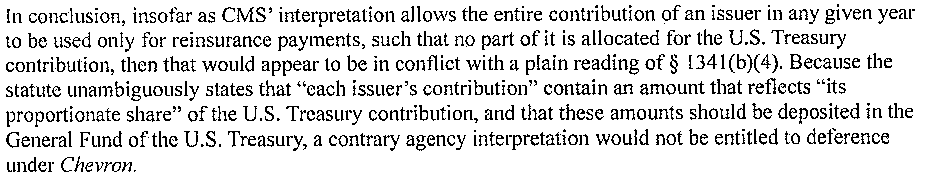

The House of Representatives requested that the Congressional Research Service investigate this issue. What did CRS find? That CMS’s decision to give $0 to the Treasury, and instead give it to insurance companies, “would appear to be in conflict with a plain reading” of the statute, and is “not entitled to deference under Chevron.”

Unsurprisingly, the Obama administration has defended this flat-out violation of the law based on claims of discretion and allocation of resources.

“We believe that we have the authorities, and as I mentioned [earlier], we actually published for comment and notice the approach that we were going to take to use those authorities, and did not have any of the concerns raised as part of that public process,” Burwell said under questioning at a Senate Appropriations Committee hearing last week.

Burwell added that she did not know if there was a legal memorandum justifying the decision. “I don’t know if it was done in that form,” she said. “I would say that we believe we have the authorities.”

HHS has routinely ignored implementation dates, arguing that there is transitional authority. I don’t buy it, but there are arguments in support of that position. However, clear instructions from Congress to appropriate funds cannot be disregarded–especially when it involves raiding funds reserved for the Treasury!

Tim Jost, offered a modest defense of the payments, calling them “reasonable” because the government did not collect enough money to cover the payments for the Treasury.

Tim Jost, a health law expert at Washington and Lee University who supports ObamaCare, saidthat he found the administration’s interpretation of the law “reasonable,” given that it did not collect enough money to cover all the costs. The primary purpose of the program is payments to insurers, not “general tax collection,” he added.

The reason why not enough money was collected was because HHS under-assessed other insurers, first in 2014, and then, even thought they knew they were under assessing, again in 2015. CMS could easily have made a supplemental assessment — except that it would piss other insurers off. The whole problem was/is entirely a self inflicted wound. But this is entirely orthogonal to the fact that the statute mandates payment to the Treasury. The government cannot simply disregard that because insurance companies are losing money under OBamacare.

Jost’s second defense is far more revealing:

“It’s the continuing struggle of the administration to make the statute work,” Jost said.

“There’s no possibility of amending [it] to try to fix the statute, so they just proceed in trying to read the statute in a way that makes it actually work,” he added. “So that’s what they’re doing here.”

As I have noted more times than I can count, the President does not get to ignore the law when Congress is gridlocked. If this is the best defense he can make, then the policy is in trouble.

The government officials involved in making these payments in flat violation of the statute should consider retaining their own counsel. DOJ will not have their best interests at heart.