The first act of the Affordable Care Act from 2009-2012 was dominated by the enactment of the law, and the Supreme Court’s decision in NFIB v. Sebelius, upholding the mandate My first book, Unprecedented, told the story of Act 1. The second act stretched from 2013 till about last week, including the Presidential election and King v. Burwell. The ACA survived both of these hurdles.Unraveled, what will be my second book, tells the story of Act 2. The third act is what happens now that the law is left to stand on its own two feet. What the legal challenges to Obamacare have always obscured is how unstable the law is all by itself.

The benefits of the ACA, which the President is fond of touting, are frontloaded. People can no longer be denied treatment for pre-existing conditions. (Although this only affected roughly 1.5 million Americans, a fairly small share compared to the 150 million number the Administration campaigned on). Twenty-six year olds can remain on their parents’ policies. Thanks to the payment of subsidies, which the Supreme Court blessed, nearly 13 million people have signed up for a qualified health plan. However, the number of Americans who benefit from this law is quite limited.

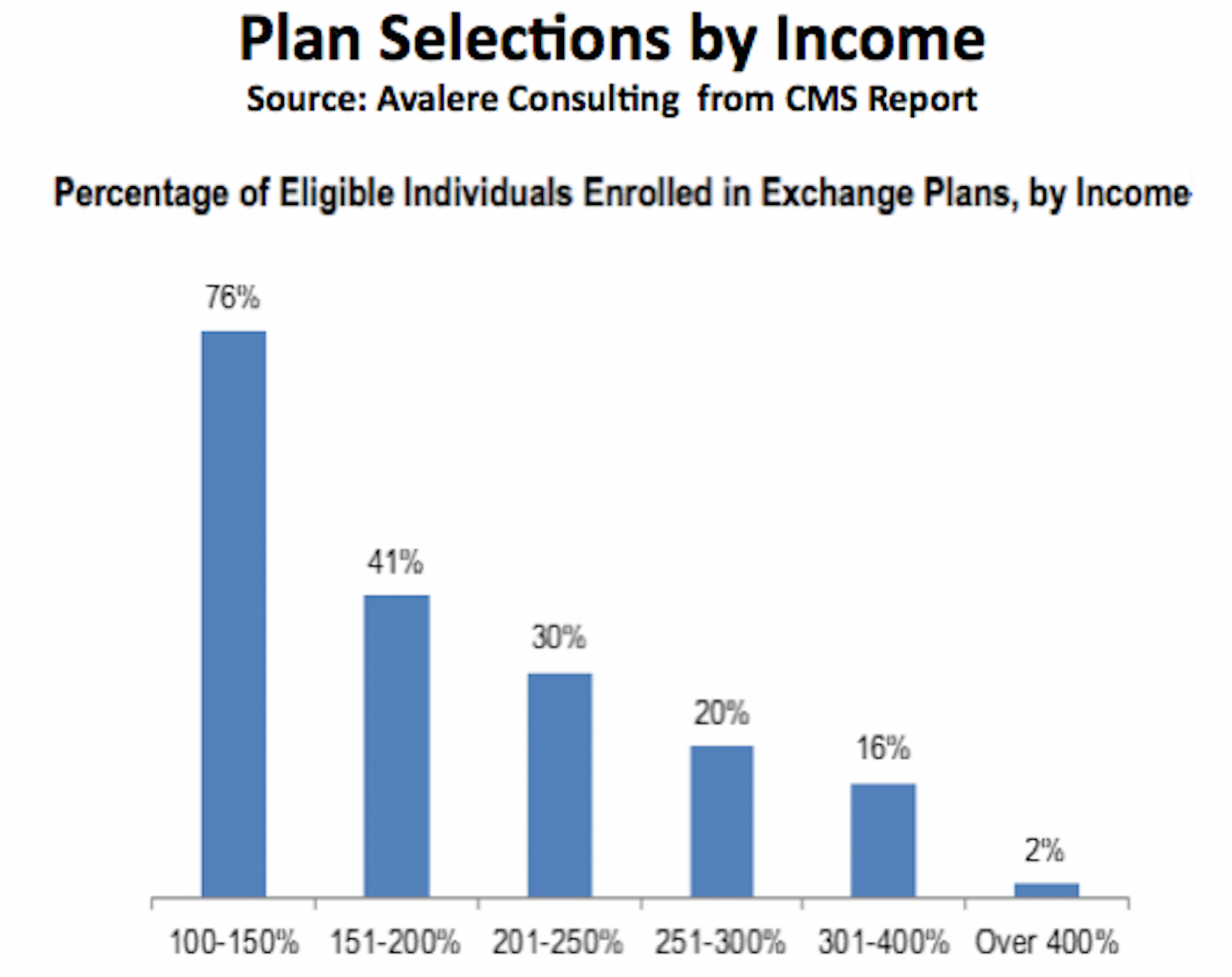

In a detailed analysis by Robert Laszewski (WonkBlog called him the “pundit of the year”) we see why the future of the ACA is far from “settled.” Consider this graphic.

For those eligible for Obamacare, an impressive 76% of those earning between 100% and 150% of the federal poverty level have signed up. [Note: the eligible up to 400% of the federal poverty level includes only those eligible for Obamacare’s insurance subsidies and does not include those in or eligible for employer-based plans.] But after that income level the percentage of those eligible who have signed up drops like a rock. The proportion of the population that is signing up for Obamacare is concentrated in the very lowest income categories while Obamacare is obviously unattractive to everyone else. It’s no secret that wealthier consumers who make more than 400% of the federal poverty level, and therefore don’t get an Obamacare subsidy, have seen their individual health insurance rates increase substantially because of the new law and haven’t been happy about it. So, this picture tells the story. Obamacare is unpopular because only the poorest have literally embraced it by buying it.

Obamacare remains unpopular among people who don’t stand to benefit. And this has had a serious impact on the cost of insurance.

After all of this and two complete open enrollments, only 40% of those who are eligible for Obamacare have signed up—far below the proportion of the market insurers have historically needed to assure a sustainable risk pool. …. Apparently, many of these families have concluded that they are better off staying uninsured and paying for their health care costs out-of-pocket. … Of course if someone in the family is really sick even premiums and deductibles this high can be a great deal.

As a result, while short of a death spiral, the markets are much older than sicker than planned.

Because, the very poor aside, the people who most often see value from Obamacare’s high priced policies and big deductibles are those who know they will use it and take more money out of the system then they will put into it.

That the Obamacare exchange population is a lot sicker than the off-exchange population has been clearly demonstrated by a recent research brief,“Understanding the Exchange Population: A Statistical Snapshot,” from Truven Health Analytics.

And thus not sustainable in its current form.

To be financially sustainable Obamacare is going to have to attract a lot more people. This program, with its high after subsidy premiums and huge deductibles, simply isn’t attractive to most consumers—unless a person is really sick. So, far the only people attracted to Obamacare are the poorest—whose premiums and out-of-pocket costs are very attractive.

What will exacerbate the skewing of the markets is that premiums continue to climb, resulting in more people foregoing insurance. The New York Times reports that insurers are seeking increases of 20-40%.

Health insurance companies around the country are seeking rate increases of 20 percent to 40 percent or more, saying their new customers under the Affordable Care Act turned out to be sicker than expected. Federal officials say they are determined to see that the requests are scaled back.

Blue Cross and Blue Shield plans — market leaders in many states — are seeking rate increases that average 23 percent in Illinois, 25 percent in North Carolina, 31 percent in Oklahoma, 36 percent in Tennessee and 54 percent in Minnesota, according to documents posted online by the federal government and state insurance commissioners and interviews with insurance executives.

The Oregon insurance commissioner, Laura N. Cali, has just approved 2016 rate increases for companies that cover more than 220,000 people. Moda Health Plan, which has the largest enrollment in the state, received a 25 percent increase, and the second-largest plan, LifeWise, received a 33 percent increase.

Jesse Ellis O’Brien, a health advocate at the Oregon State Public Interest Research Group, said: “Rate increases will be bigger in 2016 than they have been for years and years and will have a profound effect on consumers here. Some may start wondering if insurance is affordable or if it’s worth the money.”

(This story was buried on July 3, along with some other important news about the President’s new abdication of immigration law).

People who switch plans will see higher premiums, and smaller networks.

A study of 11 cities in different states by the Kaiser Family Foundationfound that consumers would see relatively modest increases in premiums if they were willing to switch plans. But if they switch plans, consumers would have no guarantee that they can keep their doctors. And to get low premiums, they sometimes need to accept a more limited choice of doctors and hospitals.

Yes, an increase in 20-40% will result in more Americans deciding to simply pay the individual mandate. What is the government doing about it? The President wants to put pressure on insurers to lower prices.

President Obama, on a trip to Tennessee this week, said that consumers should put pressure on state insurance regulators to scrutinize the proposed rate increases. If commissioners do their job and actively review rates, he said, “my expectation is that they’ll come in significantly lower than what’s being requested.”

Yeah, this doesn’t work. The insurers are already seeing the law is more expected than they planned.

Insurers with decades of experience and brand-new plans underestimated claims costs.

“Our enrollees generated 24 percent more claims than we thought they would when we set our 2014 rates,” said Nathan T. Johns, the chief financial officer of Arches Health Plan, which covers about one-fourth of the people who bought insurance through the federal exchange in Utah. As a result, the company said, it collected premiums of $39.7 million and had claims of $56.3 million in 2014. It has requested rate increases averaging 45 percent for 2016.

What about the President’s promise that insurers will spend 80% of premiums on medical care? It hasn’t been enough.

Federal officials have often highlighted a provision of the Affordable Care Act that caps insurers’ profits and requires them to spend at least 80 percent of premiums on medical care and related activities. “Because of the Affordable Care Act,” Mr. Obama told supporters in 2013, “insurance companies have to spend at least 80 percent of every dollar that you pay in premiums on your health care — not on overhead, not on profits, but on you.”

In financial statements filed with the government in the last two months, some insurers said that their claims payments totaled not just 80 percent, but more than 100 percent of premiums. And that, they said, is unsustainable.

The insurers simply underestimated the costs of Obamacare.

At Blue Cross and Blue Shield of Minnesota, for example, the ratio of claims paid to premium revenues was more than 115 percent, and the company said it lost more than $135 million on its individual insurance business in 2014. “Based on first-quarter results,” it said, “the year-end deficit for 2015 individual business is expected to be significantly higher.”

BlueCross BlueShield of Tennessee, the largest insurer in the state’s individual market, said its proposed increase of 36 percent could affect more than 209,000 consumers.

“There’s not a lot of mystery to it,” said Roy Vaughn, a vice president of the Tennessee Blue Cross plan. “We lost a significant amount of money in the marketplace, $141 million, because we were not very accurate in predicting the utilization of health care.”

And make no mistake. The Administration’s decision to exempt millions from the mandates due to the so-called “hardship” exemption further skewed these risk pools. All of the executive action that saved the law in 2013 has set it on a shaky trajectory going forward.

Things do not get better for insurers anytime soon.

Reinsurance subsidies disappear after 2016, causing premiums to go even higher.

How much support does it provide? If you use the data from the2016 draft actuarial value calculator produced by CMS, you can compute that the subsidy will still be about 3% of premiums for 2016. It was higher in 2014 and 2015. How will the ACA continue when prices increase at least 3% more just due to the elimination of this single subsidy. The naive might think that 3% is not all that much. And, without taking adverse selection into account, I would expect the market to shrink only by about an equal percentage. But if history and economics tells us anything — and it does — because of adverse selection, the actual price increase will be greater and the resulting decline in enrollment will be greater.

And the risk corridors also end after 2016.

Insurers may not have to wait until 2017 for Risk Corridors to disappear. They are already in grave trouble. Congress also never appropriated any money for Risk Corridors. And this wasn’t an accident. The statute, as written, depends on assessments on insurers based on a formula to magically equal payments out to insurers based on a formula over the 3-year span of the program. We are already seeing, as many predicted, however that such an assumption was unwarranted. Due perhaps to loss leader pricing and the predictable propensity of consumers to pick precisely those plans that were charging too little relative to actuarial risk, it appears that, on balance, at least after what I would hope would be clever but lawful accounting, that few insurers are making enough money under Obamacare policies to provide any funding to the many insurers who gained volume at the expense of profitability.

This week, Aetna acquired Humana. Expect to see more and more insurers consolidate, creating an oligopoly of providers that can weather the ACA storm.

For most Americans, the cost of Obamacare has and will continue to exceed the benefits of the law. And those costs will continue to kick in. The Cadillac Tax–a 40% excise tax on generous policies people law (including my own)–will go into effect in 2018. This will result in two-thirds of businesses taking steps to avoid the tax, and nearly 90% of employer-sponsored plans being cancelled, and employees being put onto the Obamacare exchanges.

The President has prematurely taken a victory lap and spiked the football. The real challenges begin as his term winds down.